A Guide to the EU Pay Transparency Directive 2025 | Download our eGuide for free

EBA Guidelines for Benchmarking Gender Pay Gap Data

Over the last decade, European supervisors have more heavily used remuneration practices as a risk management tool to increase accountability and to deter financial services organizations from rewarding risky behavior. Underlying this shift in mentality is the belief that organizations’ remuneration policies can support integrity and ethical behavior, thereby modulating risk-taking.

EBA Guidelines on benchmarking exercises on remuneration practices and the gender pay gap and approved higher ratios: A backgrounder

Source: European Banking Authority

Central to ethical remuneration practices is the principle of equal pay. The European Union and other European institutions have enshrined the policy of equal pay for equal work and equal pay for work of equal value in several key pieces of legislation, including the EU Pay Transparency Directive and the Treaty of the Functioning European Union (TFEU).

As a complement to these regulations, in June 2022, the European Banking Authority (EBA) published its final report, Guidelines on benchmarking exercises on remuneration practices and the gender pay gap and approved higher ratios under the CRD IV Directive (2013/36/EU). The EBA gender pay gap guidelines (Guidelines) further embody the principles of Article 157 of the TFEU of equal pay without discrimination based on gender.

The Guidelines repeal and replace the EBA's July 2014 guidelines on the remuneration benchmarking exercise (EBA/GL/2014/08), and integrate elements from the CRD V Directive for the application of derogations and gender pay gap benchmarking—the latter is what we’ll focus on in this article. The Guidelines also limit the granularity of reported metrics relative to previous iterations, and offer a (related) standardized methodology for measuring gender pay and representation gaps. This promotes consistency.

Who is subject to reporting under the EBA Guidelines?

Competent authorities (i.e., an authority appointed in a member state, see list and Section 3, Article 20 of DIRECTIVE 2007/64/EC) collect and submit data to the EBA on an individual basis from selected institutions. The first data on the gender pay gap for fiscal year 2023 will be submitted to competent authorities by June 15, 2024 and at three-year intervals thereafter (June 15, 2027, June 15, 2030, and so on).

Benchmarking the gender pay gap allows these authorities to monitor:

- The enactment and progress of equality in pay practices

- Developments at levels of different pay, including gender representation among all staff

Data is to be collected from:

- The largest institutions in a Member state in terms of asset volume within that State, ensuring coverage of at least 60% of the banking system’s total asset volume

- When 60% cannot reasonably be achieved, competent authorities should collect and submit remuneration data from up to 20 of the state’s largest entities

The Guidelines aim to capture a representative cross-section of institutions, and, to that end, have been expanded to include smaller ones. Rather than viewing the sum total of organizations’ data on a consolidated basis, the guidelines’ benchmarking exercises are based on individual institutions.

Which pay gap is captured in the EBA Guidelines’ report?

For the purposes of this report, institutions will capture the unadjusted or absolute pay gap, which is defined as “the difference, expressed as a percentage, between the average earnings of men and women across a workforce.” This shouldn’t be adjusted for other factors and can be immediately visualized in PayAnalytics’ gender pay gap solution once data is uploaded.

To capture an accurate and representative sample, selected organizations must have either 50-249 staff (excluding “the management body in its supervisory function”, meaning non-executive directors; see paragraph 44 of Guidelines) or greater than 250 staff members. Institutions of these two sizes follow a slightly different instruction manual, since organizations of 250+ calculate quartiles, for example.

To ensure proportionality in different levels of compensation and job category, institutions with 250+ staff calculate the pay gap in quartiles according to payment level as a mean and median (percentage). For specific information on differences in reporting between companies of 50-249 identified staff and companies of 250+ identified staff, see paragraph 55 of Guidelines.

Importantly, the guidelines for data collection have been revised in line with 2013/36/EU, reducing the granularity of benchmarking for different business lines—this makes them less nuanced for now, though they may be expanded at a later date. For more information on required data, see subsection 2, paragraph 20 (a) (b) (c) (d) of the Guidelines, which specifies the tables and information that institutions are required to submit to the competent authorities in their Member State (tables are included in the Guidelines’ Annex).

Which information or tables do institutions need to submit to comply with the EBA Guidelines?

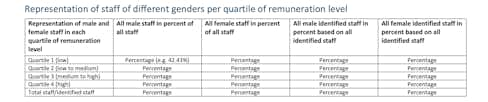

In the Guidelines’ standardized reporting format, gender pay gap information is captured in several tables, pictured below (this is not an exhaustive list).

Source: European Banking Authority

Representation among staff members at different remuneration levels (i.e., low, low-medium, medium-high, high) should be expressed as a percentage within those quartiles (keeping in mind that quartiles only apply to organizations with more than 250+ staff).

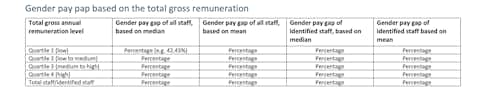

Source: European Banking Authority

Similarly, organizations calculate the difference between the mean/median remuneration of men and the mean/median remuneration of women, which is ultimately expressed as a percentage of the median/mean remuneration of men. Total gross remuneration includes non-monetary benefits (e.g., company car) and variable performance-based rewards (excluding sign-on bonuses and severance), which should be accounted for in this figure. Healthcare and pension payments should not be included.

For the mean gender pay gap, you take the average salary of all the men minus the average salary of all the women and divide it by the average salary of the men and multiply it by 100. This yields the pay gap. Using “hourly wage” as an example, if men make $18 on average and women make $15 on average, the calculation is (18-15)/18*100, which yields an approximately 17% gender pay gap.

Source: European Banking Authority

The Directive further specifies the process for including the pay of gender nonconforming and/or undisclosed/unknown gender individuals in paragraph 58 (b), and this calculation is facilitated by PayAnalytics’ software, which can visualize pay gaps for male, female, gender nonconforming, and unknown or unspecified gender.

How can organizations prepare their data for EBA reporting?

Once you have extracted the relevant data from your Human Resources Information Management (HRIM) system, you simply upload that information into PayAnalytics or import it directly via API. Within PayAnalytics’ solution, you can easily visualize and understand your data, and generate the EBA report at the click of a button. The report is generated as an Excel document, following the Guidelines’ required format.

During this stage, before you perform an analysis in the system, you are viewing the unadjusted pay gap (as required by the Guidelines). However, if you want to move forward and closer to pay equity, PayAnalytics will support you in every step of your journey. For instance, the system uses regression analysis to analyze pay gaps across your organization; once you’ve run your first analysis, you are able to account for bona fide determinants (i.e., not invalid variables like gender or race) of pay, such as job family, years of experience, or level of education.

In addition, the system offers employee-level recommendations to close pay gaps and shows you the cost of closing them, while outlining where the gender balance at your organization can be adjusted to promote DE&I objectives.

What steps can organizations take if they have identified a pay gap before or after EBA reporting?

Once you’ve taken action to address your pay gaps—no matter how incremental—a consistently applied pay philosophy and clearly outlined pay practices will help you maintain the pace of change.

Tools such as our Compensation Assistant help you maintain parity by giving internally fair suggestions for the salaries of new employees and those who are moving into a new position.

When the next reporting period arrives, if your institution is selected by the relevant regulatory bodies to submit gender pay gap information, you will have made strides toward meeting the goals of gender equality laid out in key legislation—including the EU Pay Transparency Directive and the Guidelines.

Fair pay is an ongoing process. As the philosopher Will Durant once put it—and we tend to agree—“We are what we repeatedly do. Excellence, then, is not an act, but a habit.”

Whether you’re just starting or have been conducting pay equity audits for years, our global solution helps you comply with all primary regulatory environments, including the E.U./E.E.A and the U.S., among others.

Please feel free to reach out to us at any time if you’d like to discuss how PayAnalytics can help you to comply with the EBA Guidelines (and other regulation). We’d also love to give you a tour of the software in a 1:1 with our fair pay specialists.

While you’re here, don’t forget to download your copy of the EU Pay Transparency e-book.

The information on this page is not intended to serve and does not serve as legal advice. All of the content, information, and material in this article are only for general informational use. Readers are advised that this information, legal or otherwise, may not be up-to-date.